income tax rates 2022 ireland

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. These limits are increased in respect of dependent.

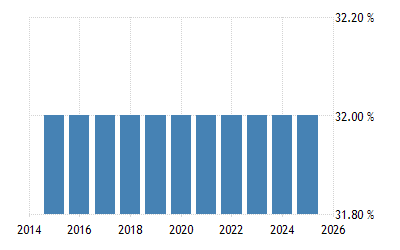

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

You will need to understand how tax credits and rate bands work.

. Standard rates and thresholds of USC for 2022. Get a quote today. There are seven federal income tax rates in 2022.

We help landlords across Ireland file their rental income tax return. This guide is also available in Welsh Cymraeg. Use our interactive calculator to help you estimate your tax position for the year ahead.

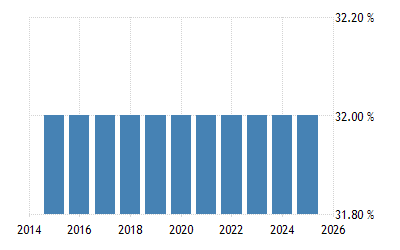

In 2022 for a single person with an income of 25000 the effective tax rate will be 120 rising to 198 at an income of 40000 and 404 at an income of 120000. For 2022 the specified limit is EUR 18000 for an individual who is singlewidowed and EUR 36000 for a married couple. Calculating your Income Tax gives more.

What will the provisions contained in Budget 2022 mean for you. The personal income tax system in Ireland is a progressive tax system. Payments and income exempt from USC.

The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your income tax and salary after tax based on a Annual. Ad A high quality low cost tax return service for Irish landlords. The current tax year is from 6 April 2022 to 5 April 2023.

Table 1 presents the results of this analysis. Tax Rates in Ireland for 2022 To give you a clearer picture of the taxes youll pay on earnings we collected the 2022 rates for Irish income tax and contributions for the USC and PRSI in one. Your tax-free Personal Allowance The standard Personal Allowance is 12570.

This page tells users how Income Tax is calculated using tax credits and rate bands. This is known as the standard rate of tax and the amount that it applies to is known as the standard rate tax band. Close companies see the Income determination section may be subject to additional.

Tax rates and credits 2022 PRSI contribution changed Universal Social Charge changed Income Employer1105 No limit 88 If income is 410 pw or less Employee class A1. Minister for Finance Paschal Donohoe has said a 30 rate of income tax is technically possible and that Budget 2023 will contain an overall personal tax package that. Other rates of USC.

Based on Budget 2022 we calculated effective tax rates for a single person a single income pair and a two-earner couple. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher. A standard rate of 20 which applies to lower income levels and a standard tax band of 40 which applies to.

Ireland Income Tax Rates for 2022 Ireland Income Tax Brackets Ireland has a bracketed income tax system with two income tax brackets ranging from a low of 2000 for those earning. Ireland Personal Income Tax Rate - 2022 Data - 2023 Forecast - 1995-2021 Historical Ireland Personal Income Tax Rate The Personal Income Tax Rate in Ireland stands at 48 percent. Ad A high quality low cost tax return service for Irish landlords.

We help landlords across Ireland file their rental income tax return. Depending on the profit yield of a site the tax rate applicable can range from 25 to 40. Taxation in Ireland Irish Income Tax is a progressive tax with two tax bands.

Get a quote today. Reduced rates of USC. Standard rates and thresholds of USC.

Tax rates bands and reliefs The following tables show the tax rates rate bands and tax reliefs for the tax year 2022 and the previous tax years. The first part of your income up to a certain amount is taxed at 20.

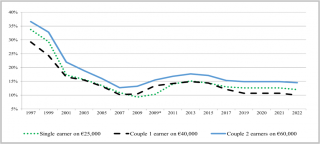

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

2022 Capital Gains Tax Rates In Europe Tax Foundation

How Do Taxes Affect Income Inequality Tax Policy Center

Free Photo Finances Saving Economy Concept Female Accountant Or Banker Use Calculator Business Loans Finance Saving Accounting Firms

Effective Tax Rates After Budget 2022 And Why Ireland Remains A Low Tax Country Social Justice Ireland

Ireland Tax Income Taxes In Ireland Tax Foundation

Corporation Tax Europe 2021 Statista

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

2022 Tax Inflation Adjustments Released By Irs

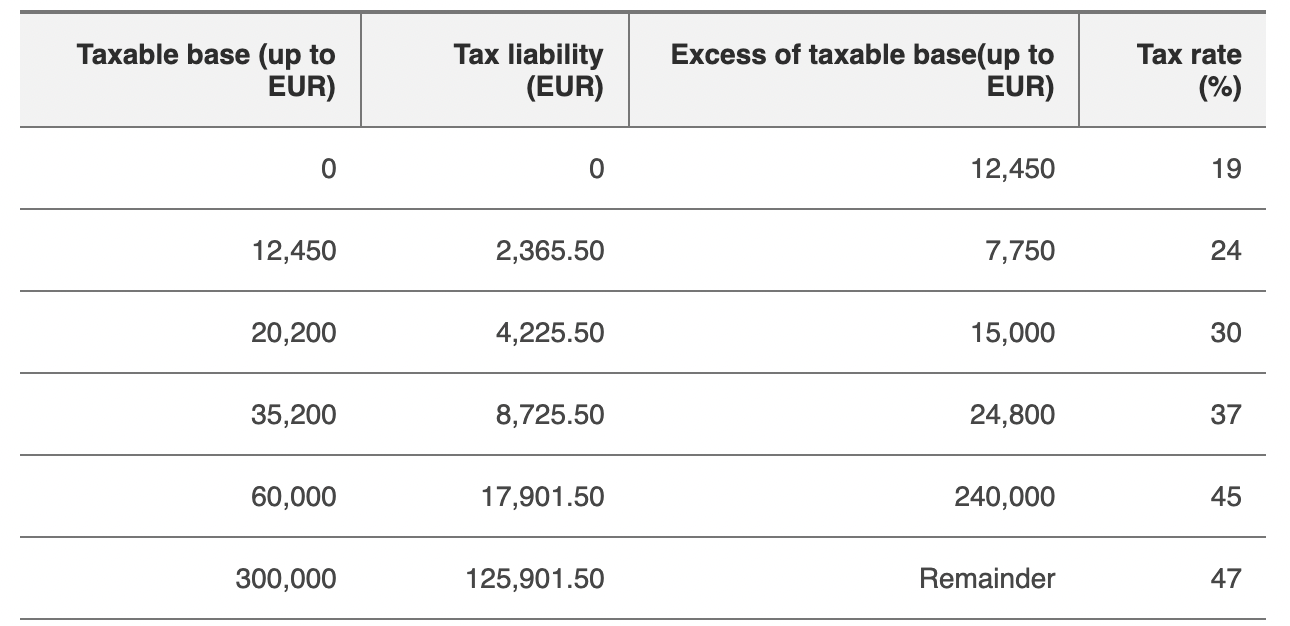

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

10 Best Workflow Management Software Of 2022 Business Process Management Marketing Software Wrike

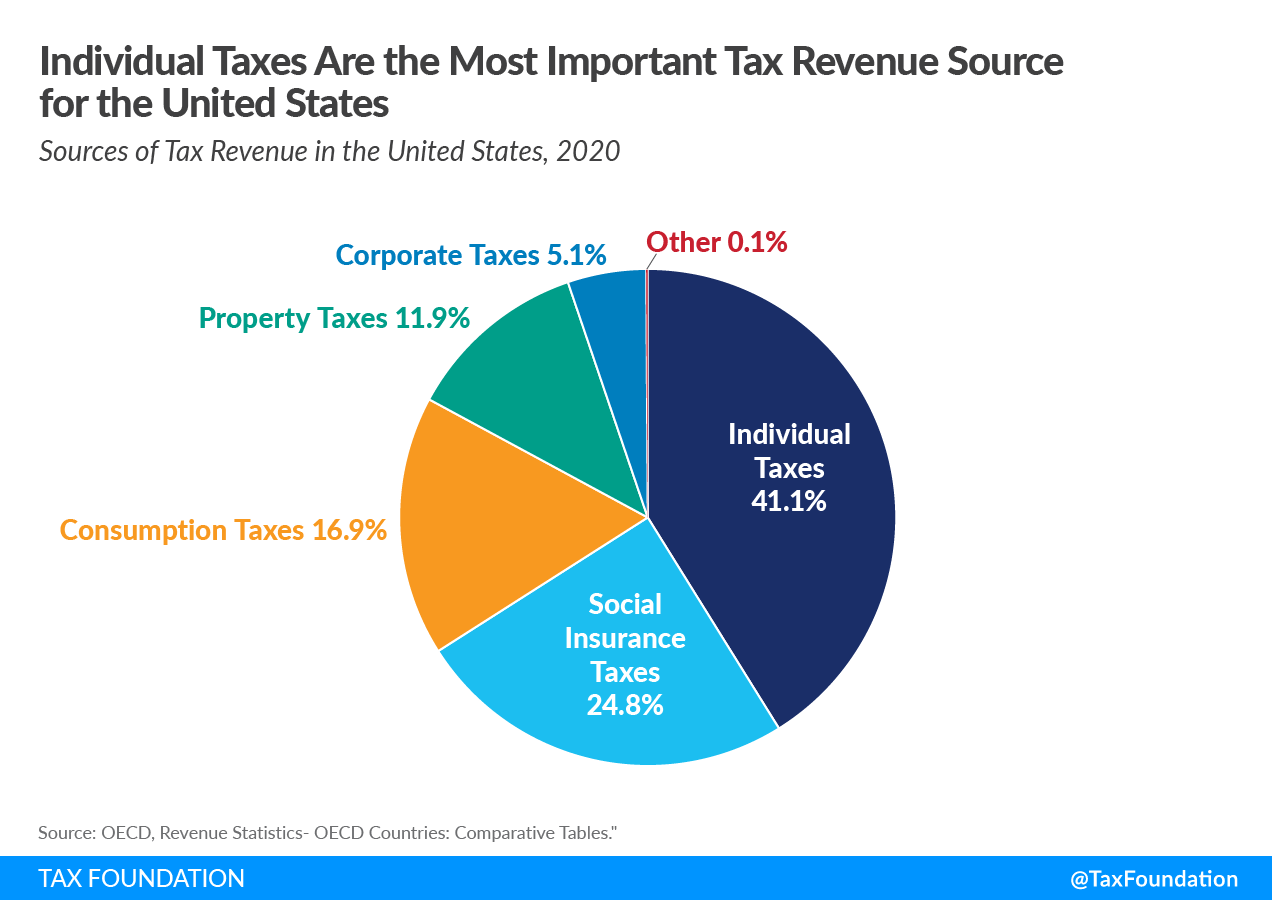

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

Prachi Ca I Will File Indian And Candian Corporate And Personal Tax Returns For 20 On Fiverr Com Tax Income Tax Tax Return

Russia Mulls Counter Embargo 10 Yr Ban On Foreign Firms Which Don T Return By May 1 In 2022 Economic Development Government Letter Addressing

Tax Services Include Tax Deductions Accounting Job And Online Accounting We Have The Best Quality Accountants On Bookkeeping Services Accounting Tax Attorney

Explainer What Is The New Tax Bracket And What Does It Mean For Me

Population Change In U S States Canadian Maps On The Web In 2022 Canadian Provinces Map States